About:

Green Compass is a digital tool that simplifies ESG compliance by helping businesses navigate complex sustainable reporting. It bridges the gap between technical EU regulations and practical corporate assessment.

Challenge:

Translating the massive, technical density of EU Taxonomy and CSRD requirements into a clear, usable format for non-experts.

Impact:

I reduced regulatory complexity, improved data clarity, and increased users’ confidence in navigating EU Taxonomy and CSRD compliance.

Role:

User research & regulatory analysis

UX and UI design

Data visualization for EU Taxonomy

Design library kit

Usability testing

Industry:

Sustainable Finance

Time:

Mar 2023 – Sep 2023

How it started…

A single tweet sparked our journey to uncover if there’s a real issue with PayPal.

So, we decided to dig deeper

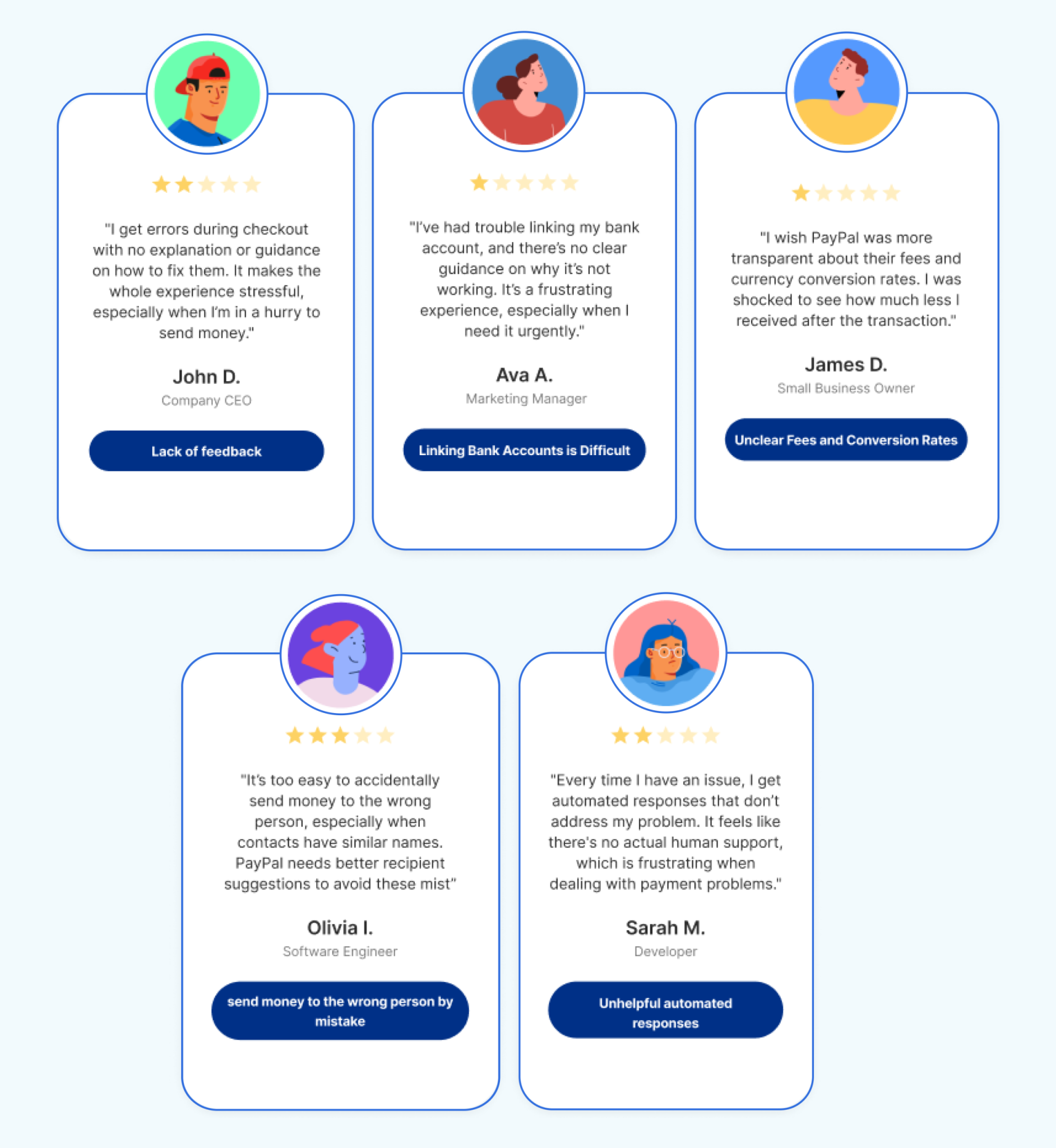

While PayPal is known for its simplicity and security, it struggles with limited guidance, challenges in linking bank accounts, unclear fees and conversion rates, and the risk of sending money to the wrong person. Additionally, the automated customer support provides little assistance.

When it comes to money, people expect every interaction to be clear, reliable, and stress-free.

-

➖ Recipient search

How do we simplify finding recipients to ensure a seamless transaction experience?

-

➖ Transparency

How do we clarify conversion rates & fees so users know the exact amount sent or received?

-

➖ Managing account

How do we simplify linking bank accounts & managing sources for confident financial management?

What did we do?

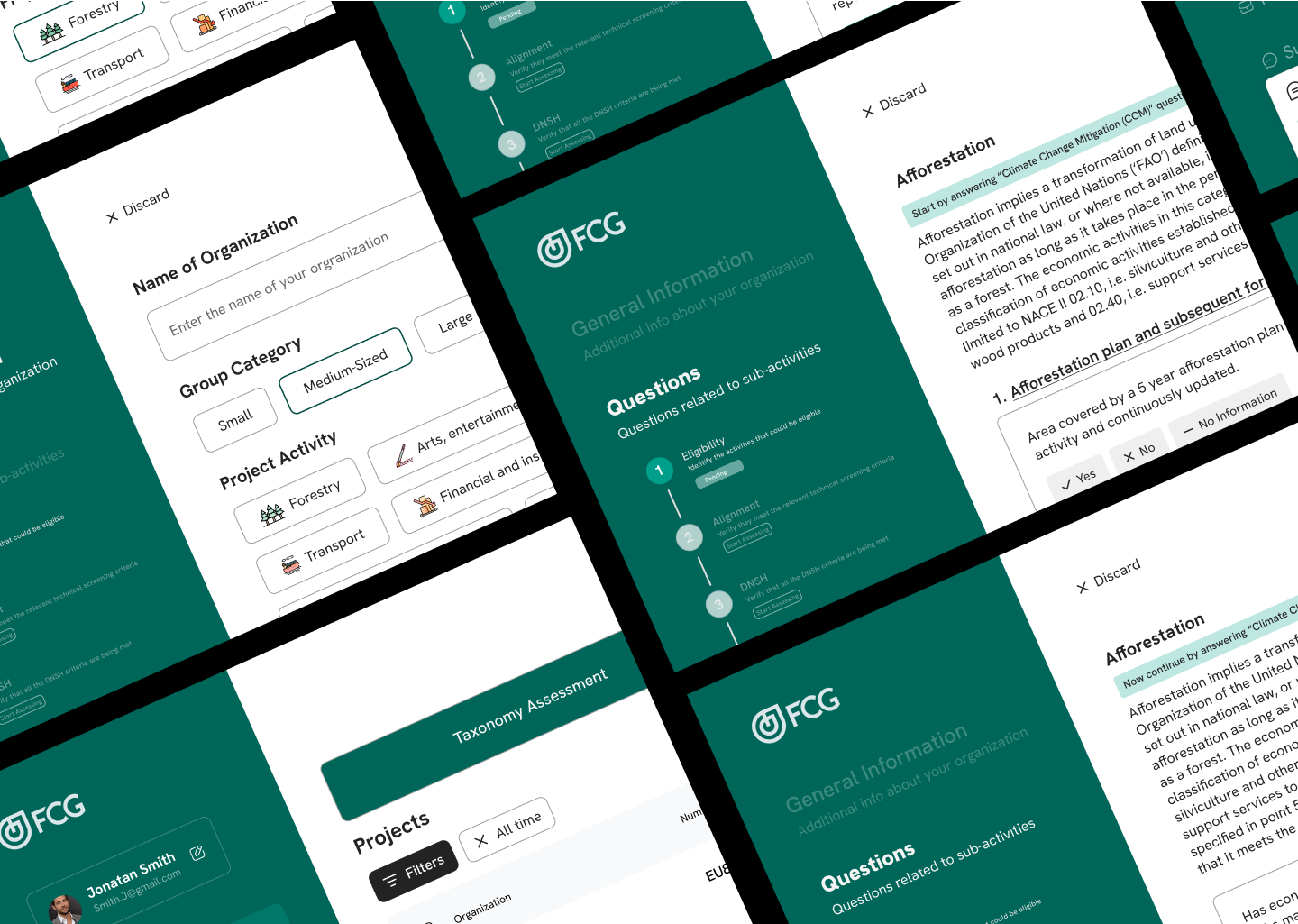

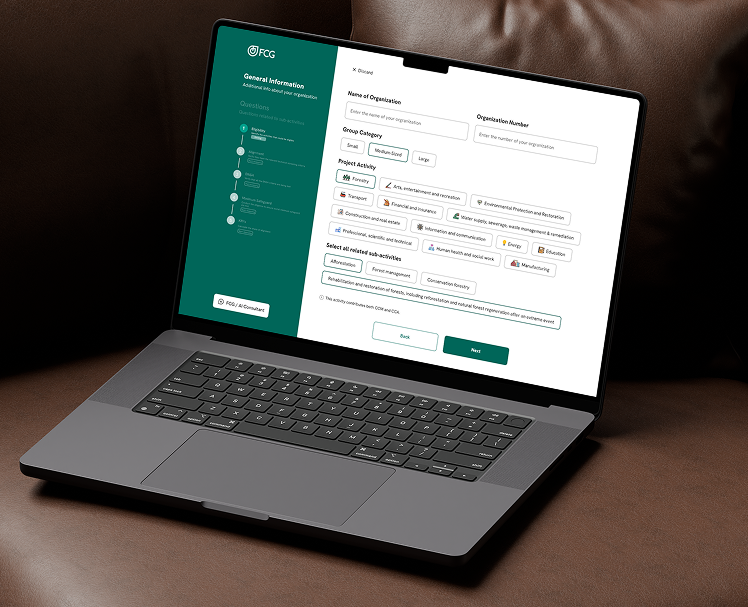

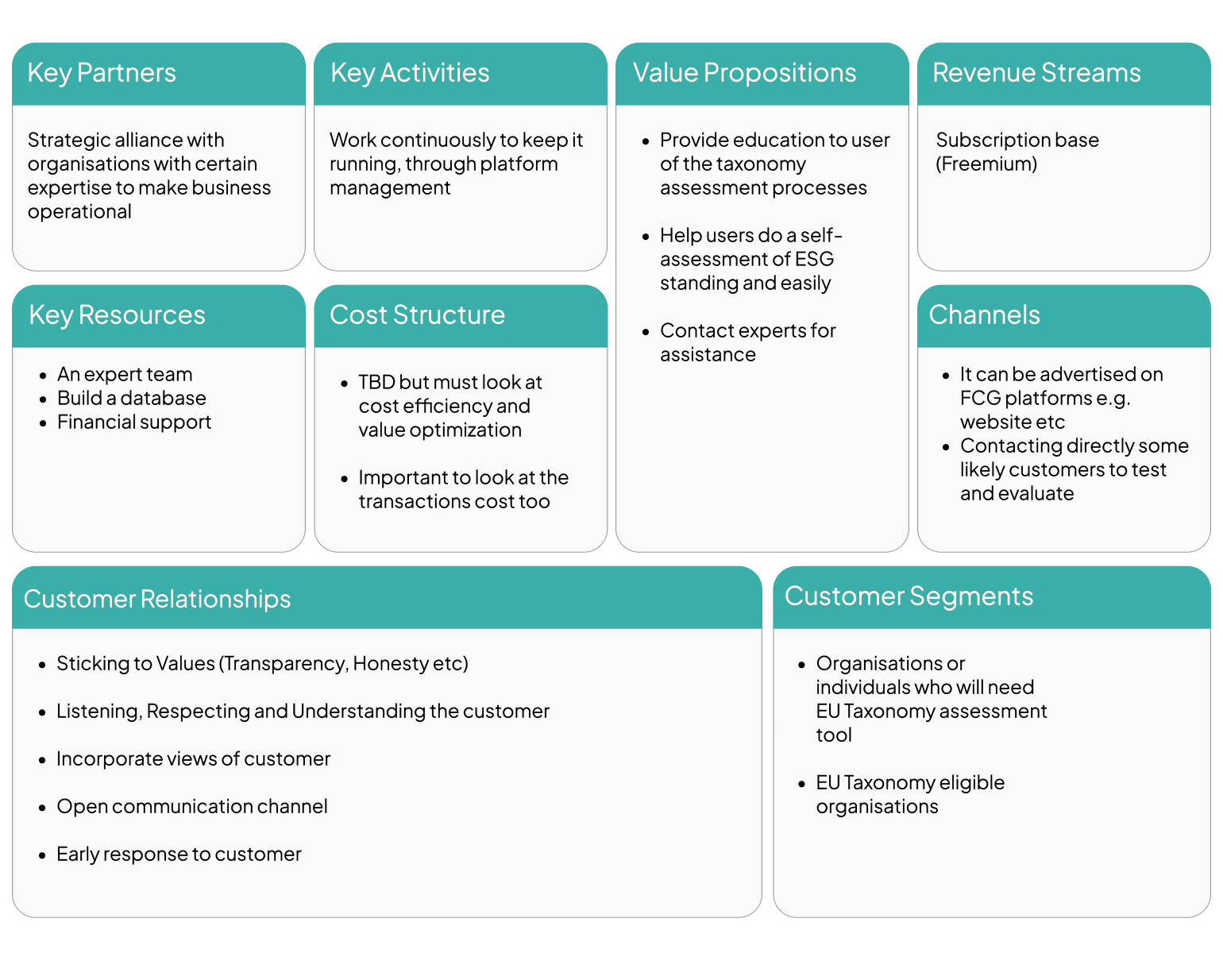

We designed Green Compass, a tool that simplifies the EU Taxonomy assessment process, helping businesses understand and align with sustainable finance regulations. Through research and iterative design, we created a user-friendly platform that clarifies compliance requirements and enhances accessibility.

What is the problem?

Navigating the EU Taxonomy framework is complex, time-consuming, and overwhelming for businesses, especially small and medium-sized enterprises (SMEs).

Many companies struggle to understand regulatory jargon, assess eligibility, and track compliance, which hinders sustainable investment decisions.

Impact

By designing an intuitive, structured tool, we aimed to:

- Enable companies to self-assess and upload relevant documents effortlessly.

- Provide clarity on ESG criteria, making compliance accessible.

- Support businesses in driving positive change locally and globally.

How it started…

We began by exploring the struggles businesses face with EU Taxonomy compliance. Our goal was to identify pain points and opportunities to create a solution that simplifies the assessment process.

Behind the scenes we interviewed sustainability consultants, financial officers, and compliance experts to uncover their challenges. We also conducted competitive research to analyze existing tools and frameworks, evaluating their usability, clarity, and effectiveness.

- How do businesses currently approach EU Taxonomy compliance?

- What are the biggest pain points in the assessment process?

- What information do users need to make informed decisions?

- How can we improve accessibility and usability?

Regulatory docs read like legal puzzles. Users wanted simple, actionable steps not walls of text.

They didn’t know where they stood. A live compliance status would be a game-changer.

Assessments were fragmented across spreadsheets and PDFs.

An integrated platform was high on the Wishlist.

Key takeaways

- Accessibility matters: Simplified explanations help users navigate regulations with ease.

- Transparency builds trust: Real-time feedback reassures businesses about their sustainability alignment.

- Integration improves efficiency: Combining assessment, tracking, and reporting in one tool reduces friction.

Next Time?

- Involve more diverse industry representatives in early research.

- Explore deeper AI-driven automation for enhanced decision-making.

- Conduct longitudinal studies to track long-term impact on compliance processes.

Conversion (CR)

Led to a marked increase in successful payment confirmations.

Abandonment (CAR)

Decreased user exit during the process.

Time to Completion

Resulting in a vastly more efficient user experience.

Trust & Clarity

Boosted user satisfaction and confidence.