About:

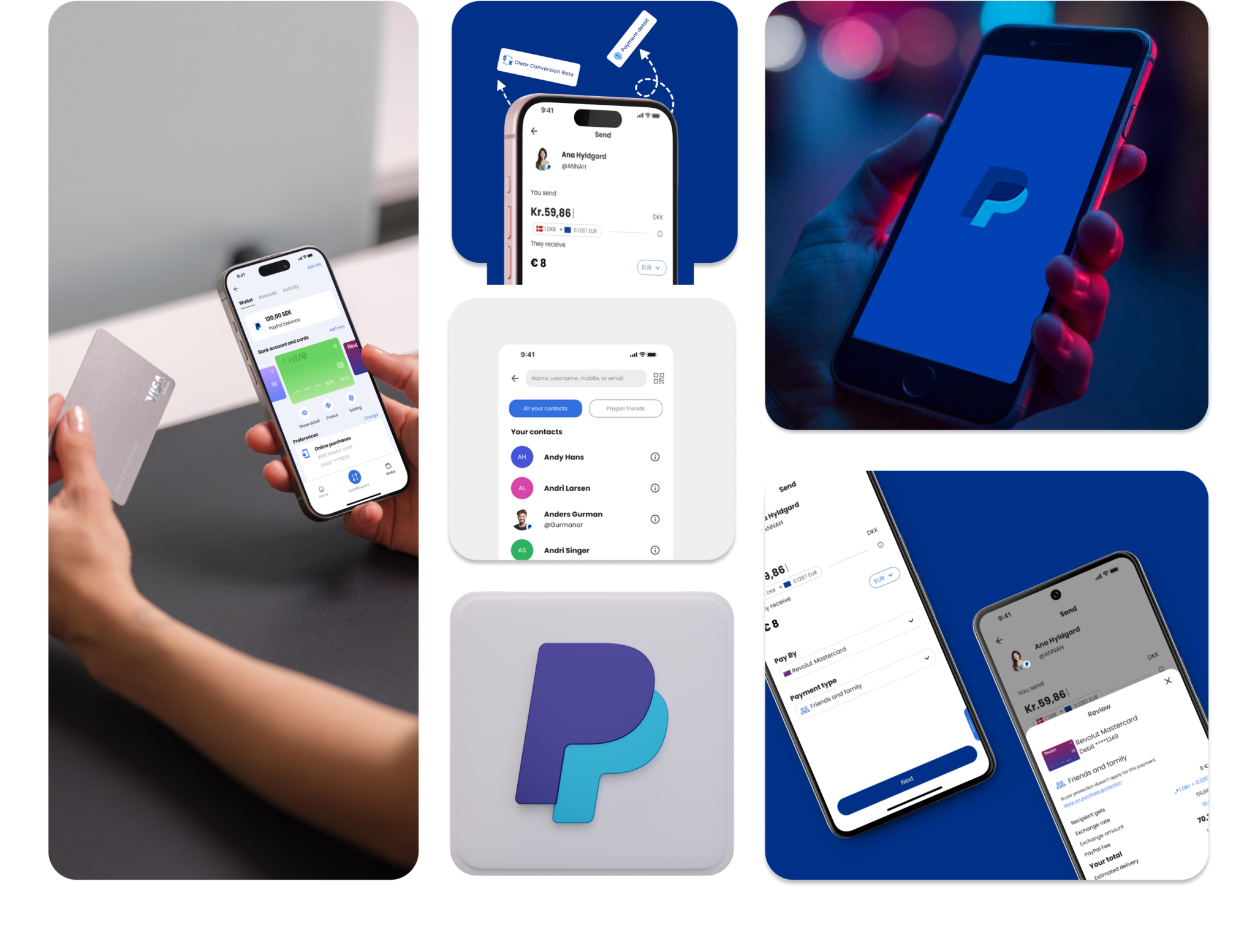

PayPal is a widely used online payment platform that facilitates secure transactions and money transfers.

Challenge:

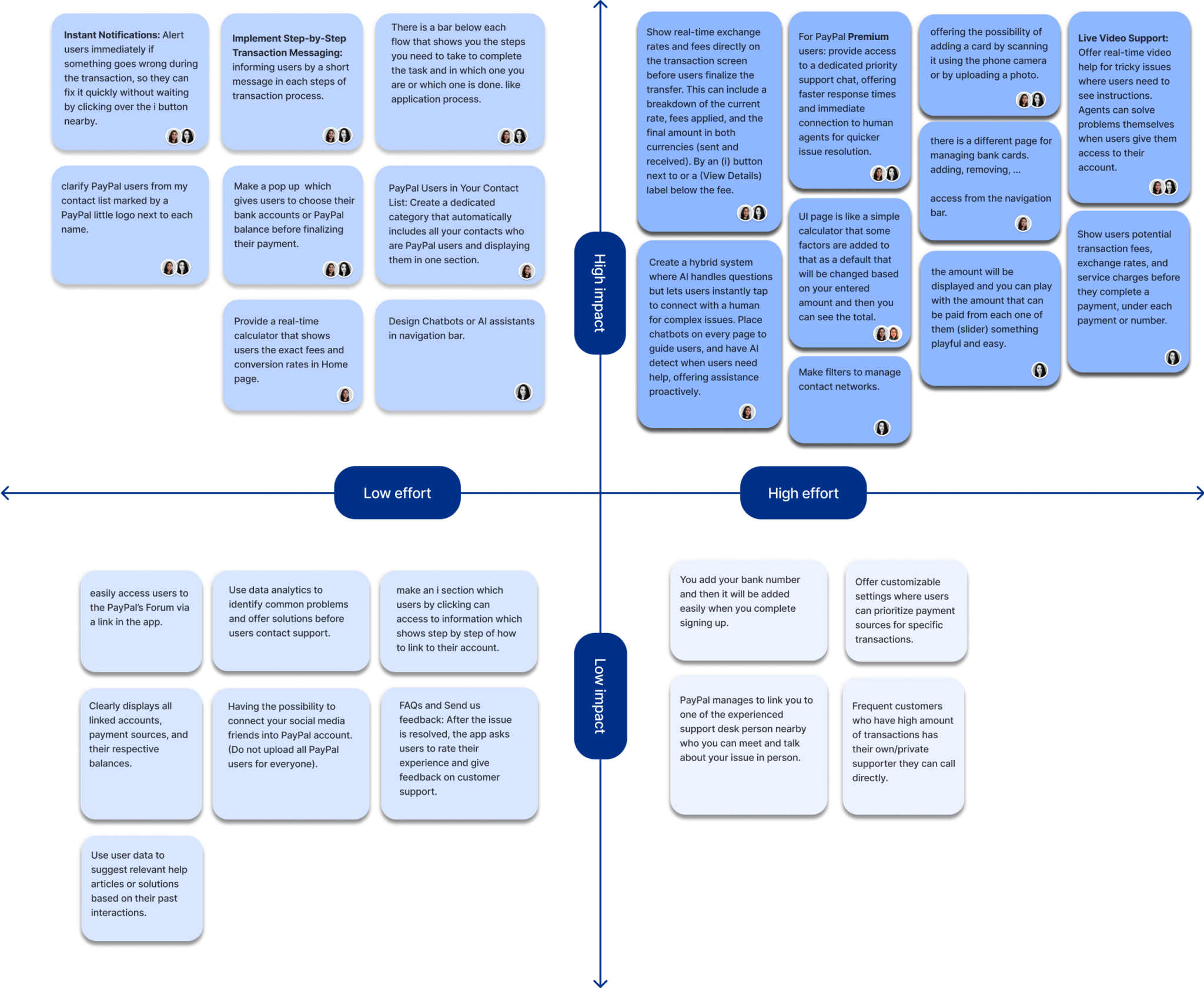

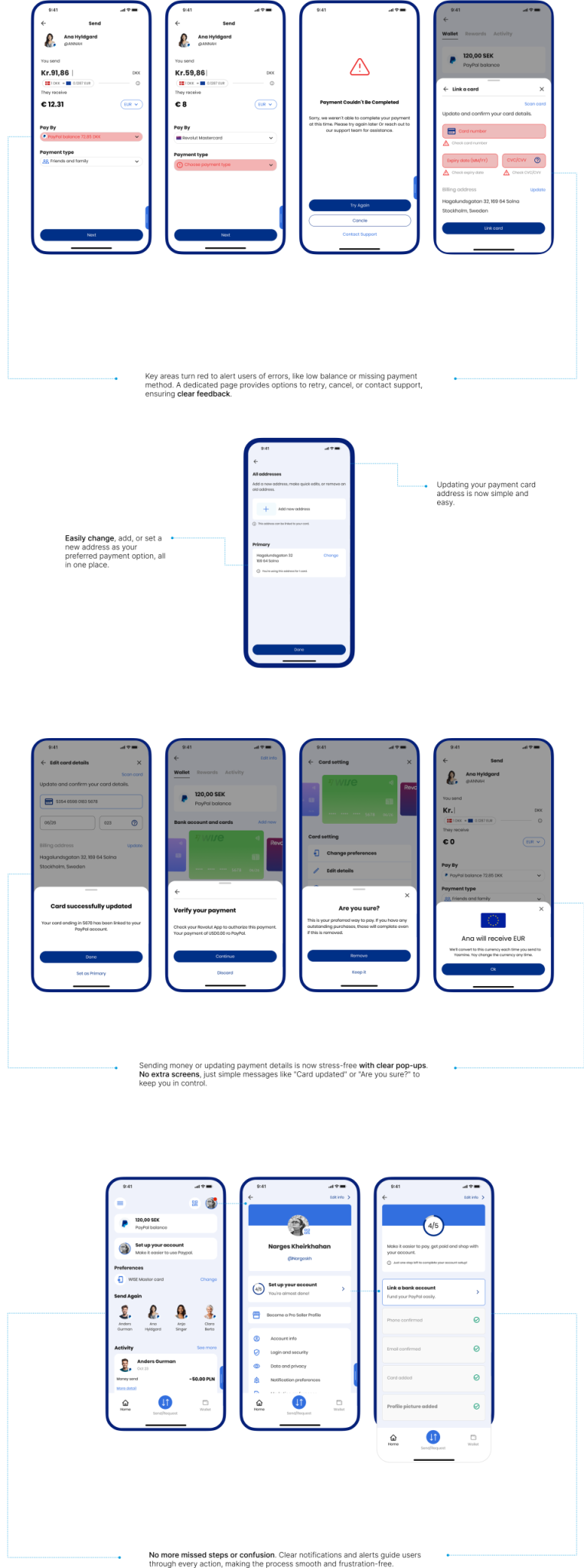

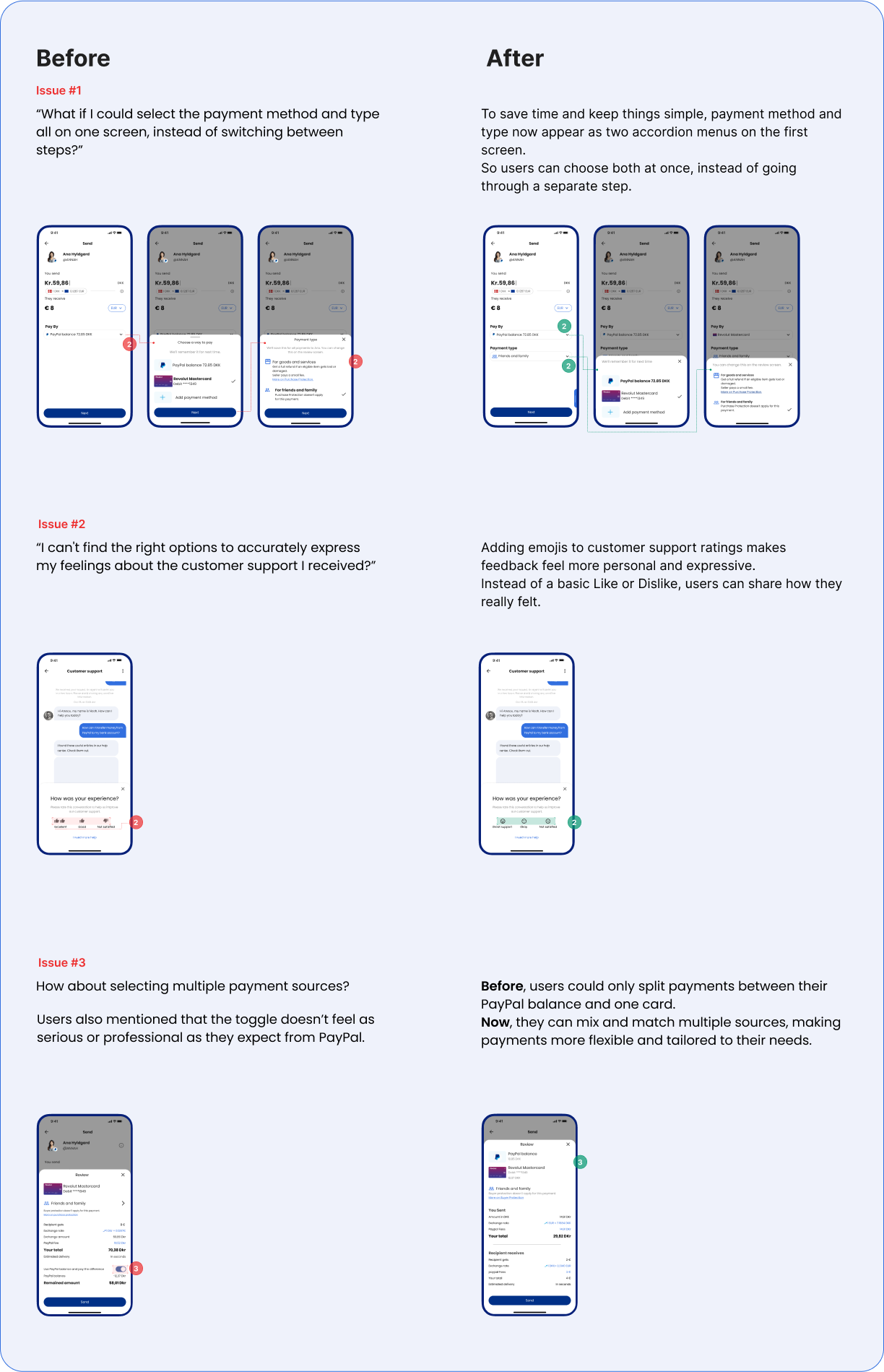

Unclear fees, account linking and a confusing flow that reduced user confidence during P2P transactions.

Impact:

I reduced confusion, improved fee clarity, and increased users’ confidence in completing P2P transactions.

Role:

User research & analysis

UX and UI redesign

Design library kit

Usability testing

Industry:

FinTech

Time:

Oct 2024 – Nov 2024

Led to a marked increase in successful payment confirmations.

Decreased user exit during the process.

Resulting in a vastly more efficient user experience.

Boosted user satisfaction and confidence.

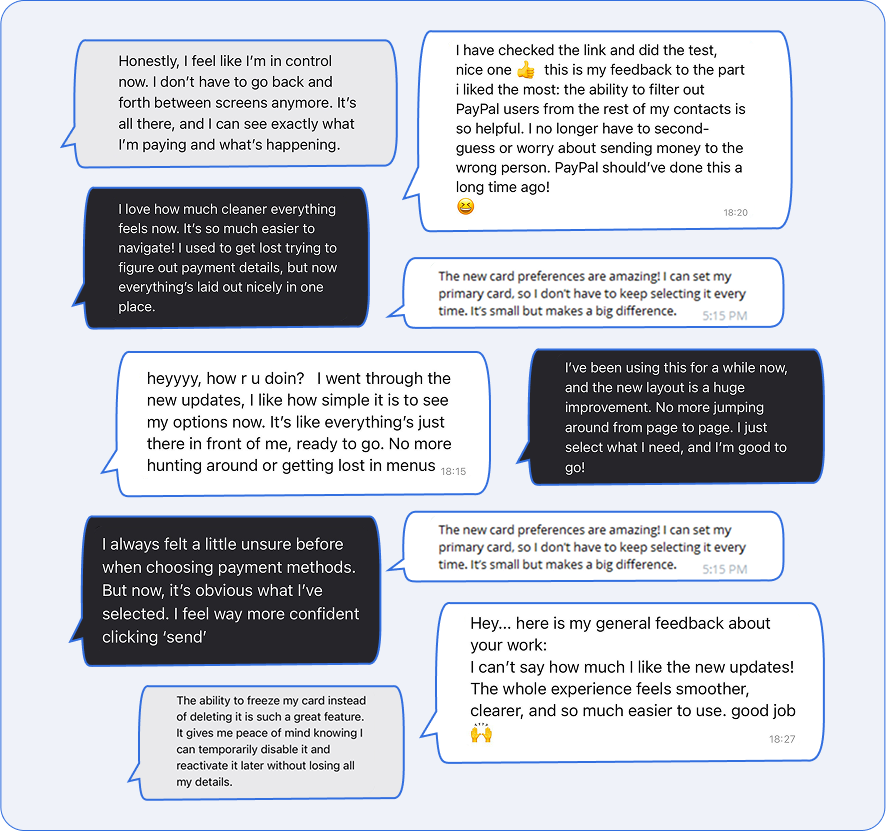

A single tweet sparked our journey to uncover if there’s a real issue with PayPal.

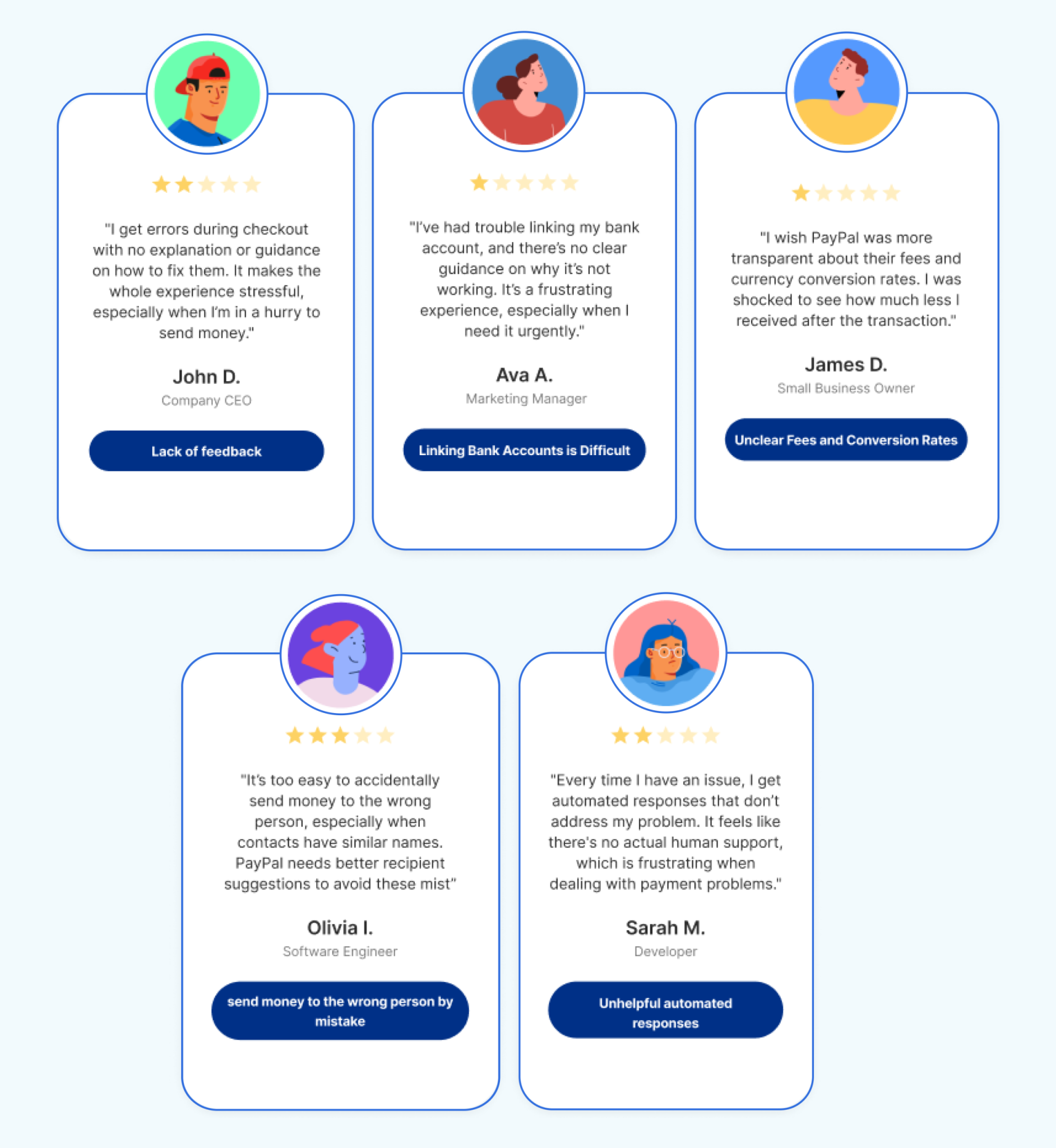

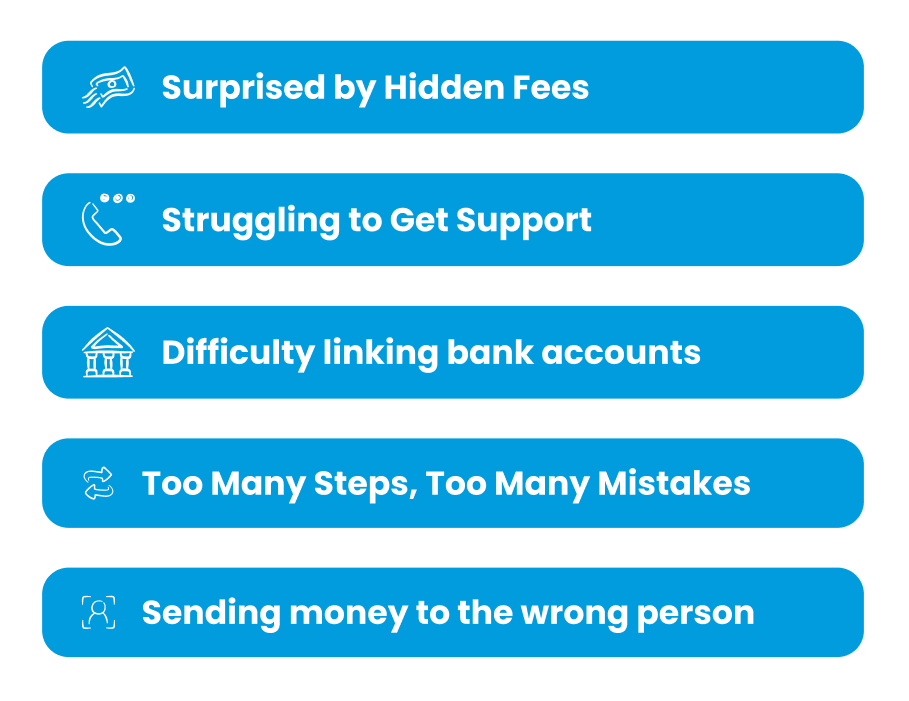

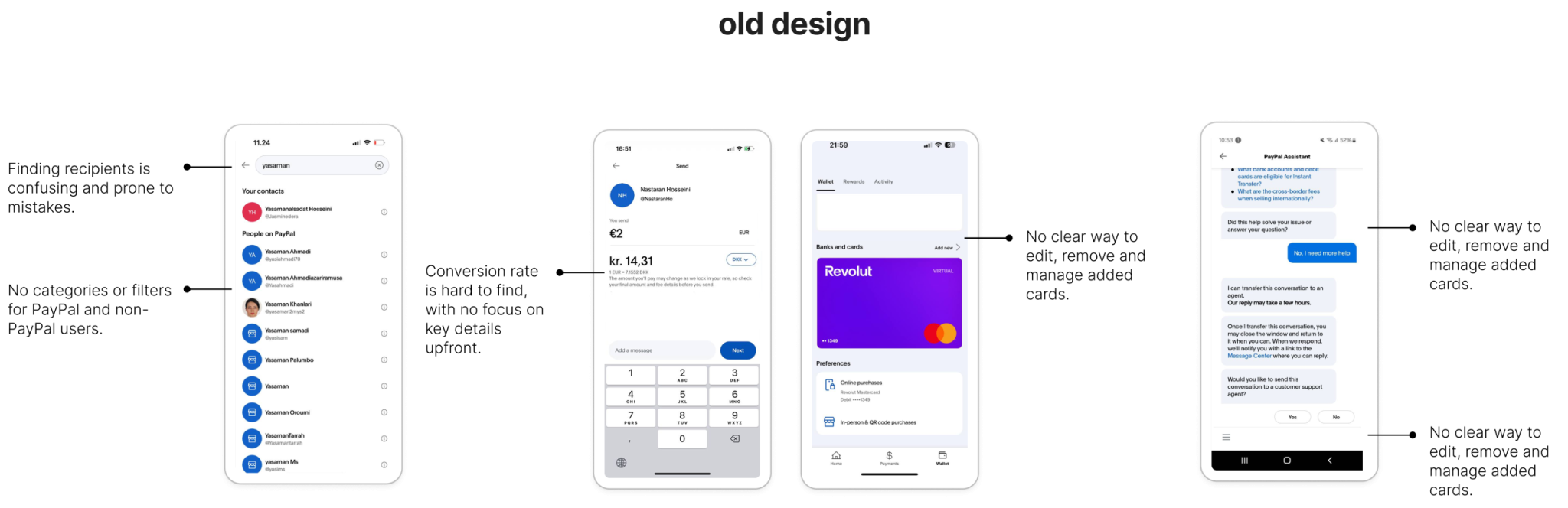

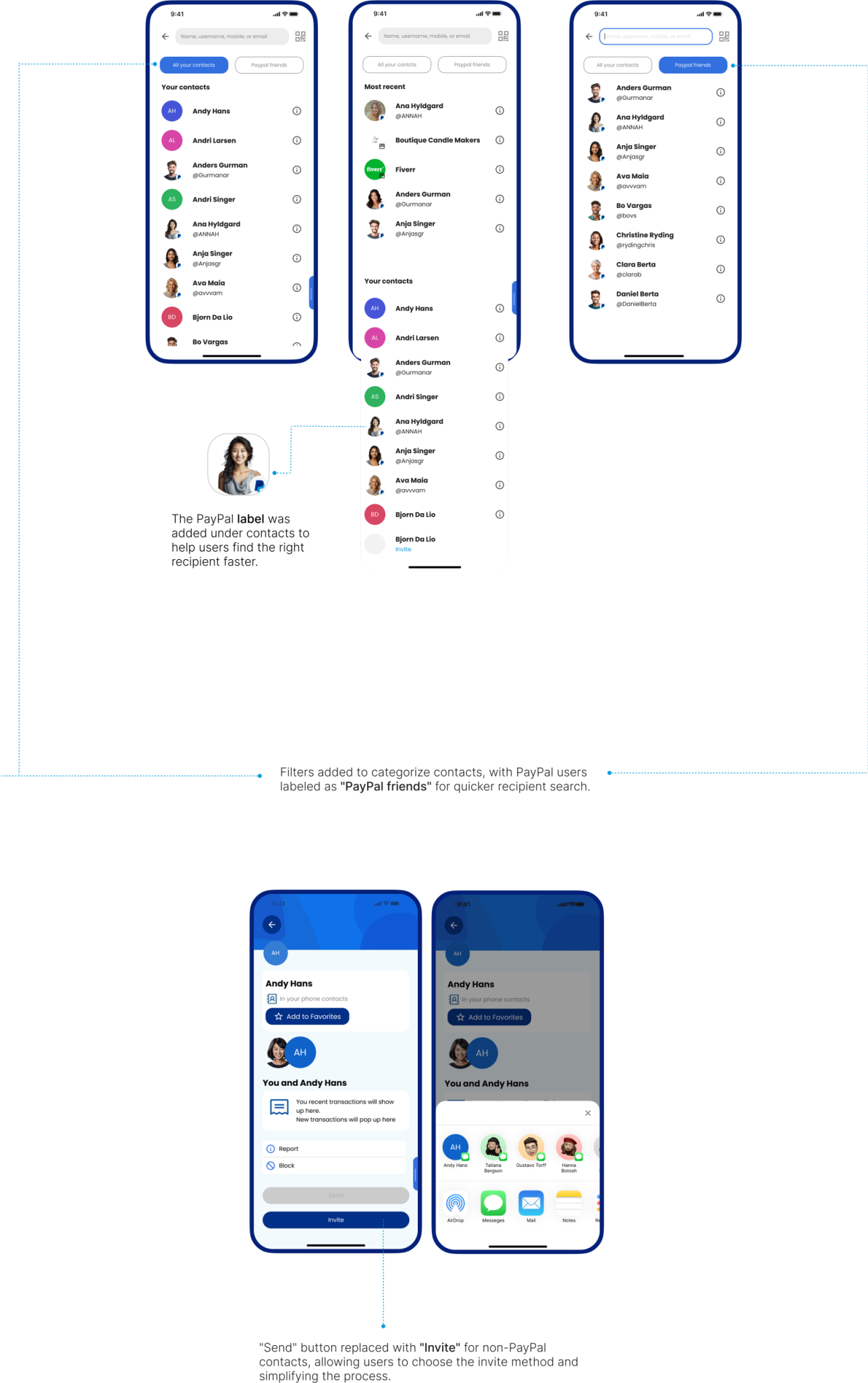

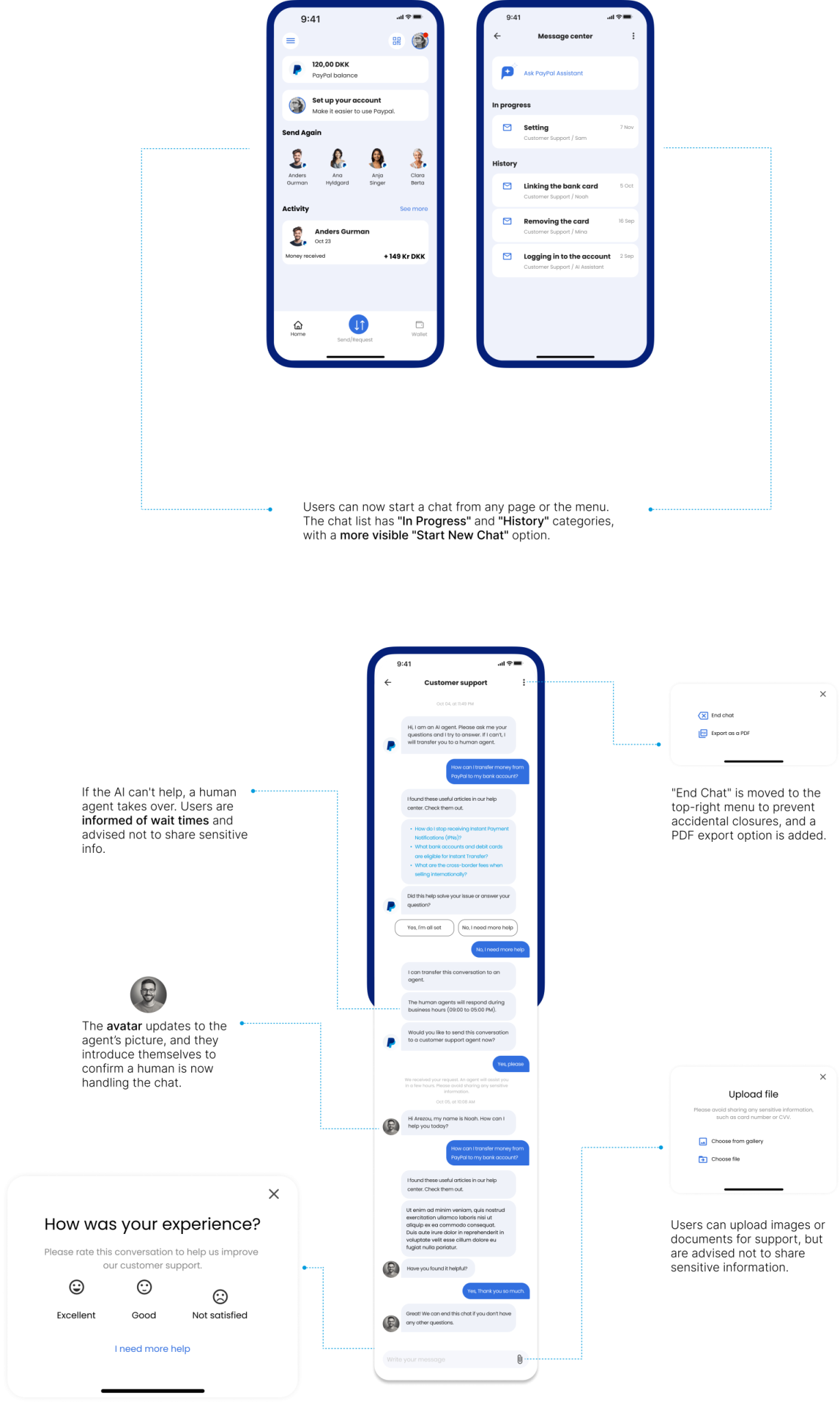

While PayPal is known for its simplicity and security, it struggles with limited guidance, challenges in linking bank accounts, unclear fees and conversion rates, and the risk of sending money to the wrong person. Additionally, the automated customer support provides little assistance.

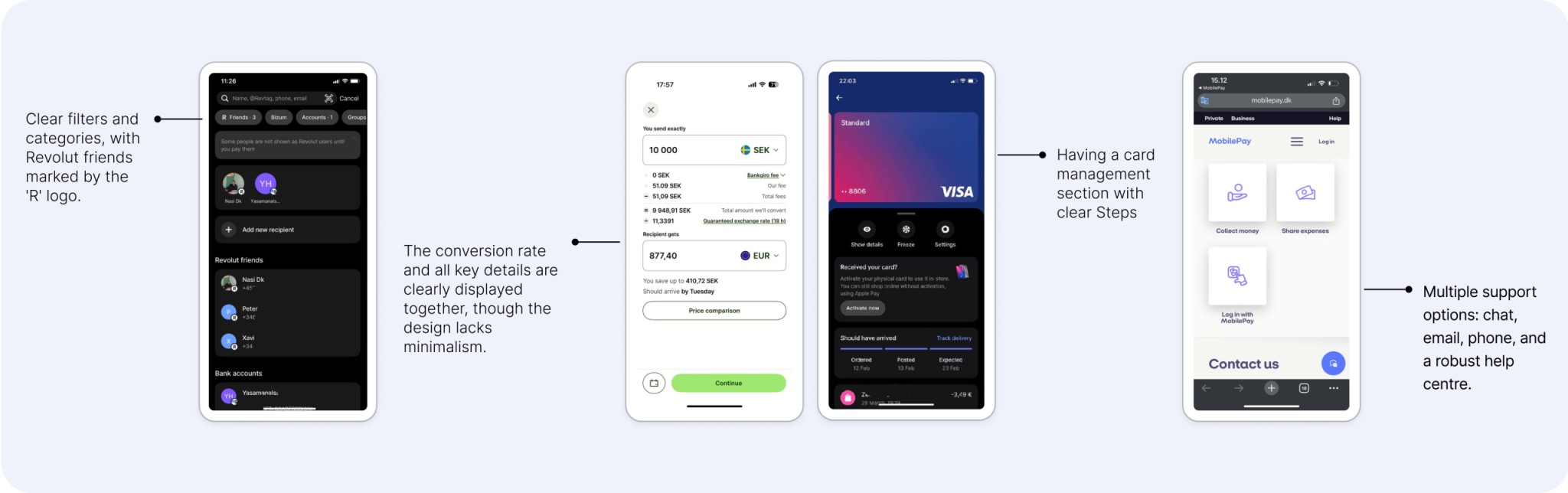

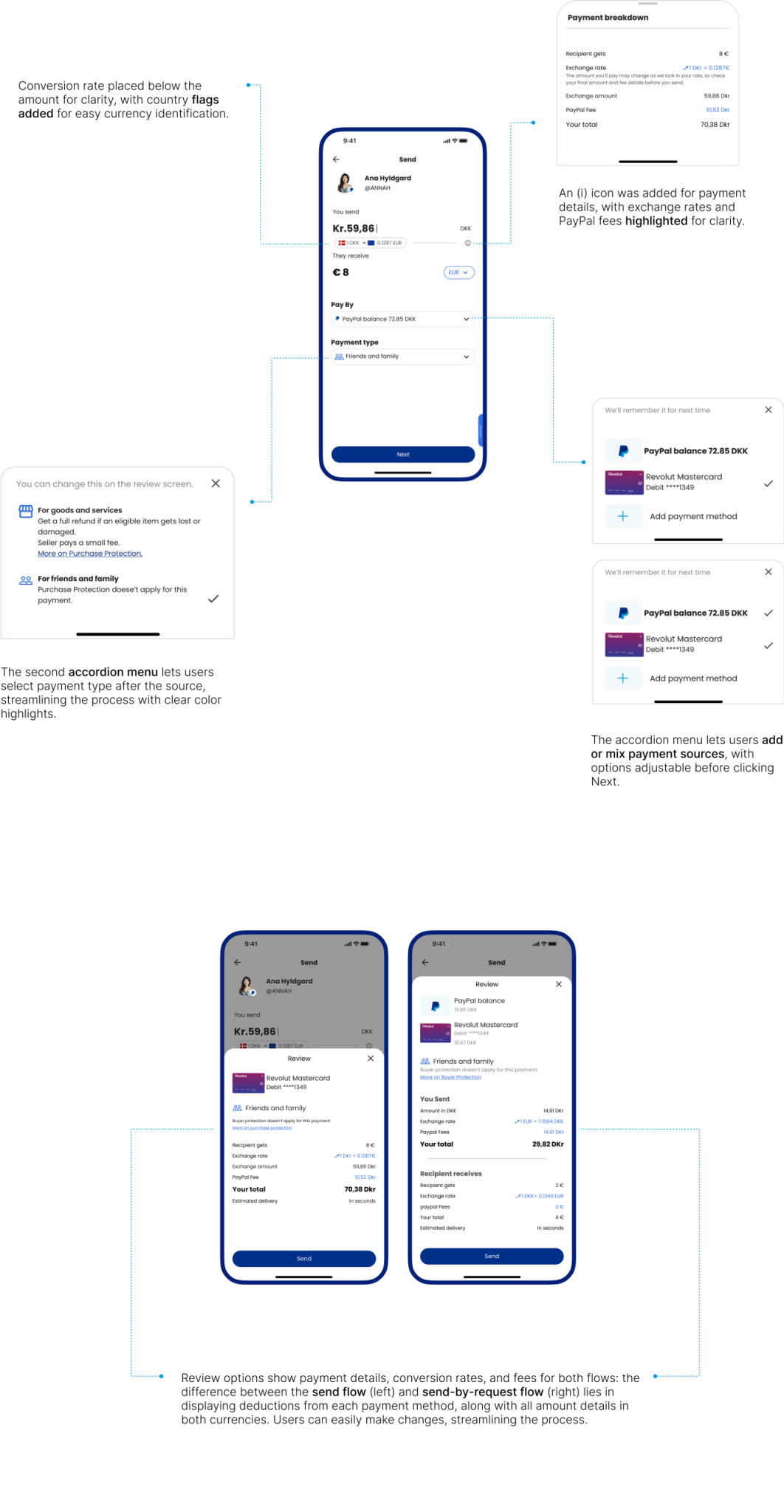

People who’ve used PayPal for a few years want clear information about fees. They like it when the app is simple, fast, and helps them feel in control, especially when sending money abroad.

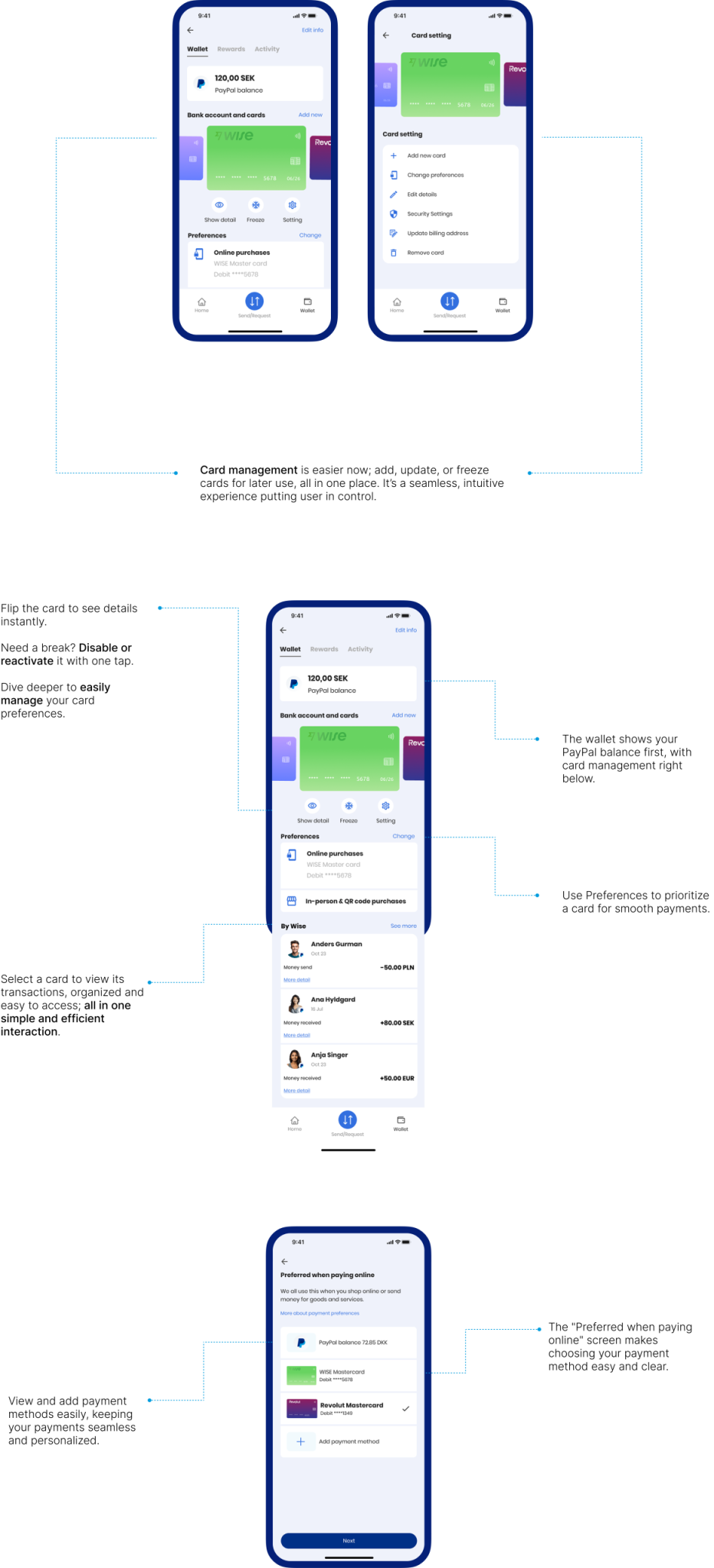

Users face unexpected friction that disrupts their flow and confidence. This creates hesitation and reduces their overall satisfaction, limiting engagement.

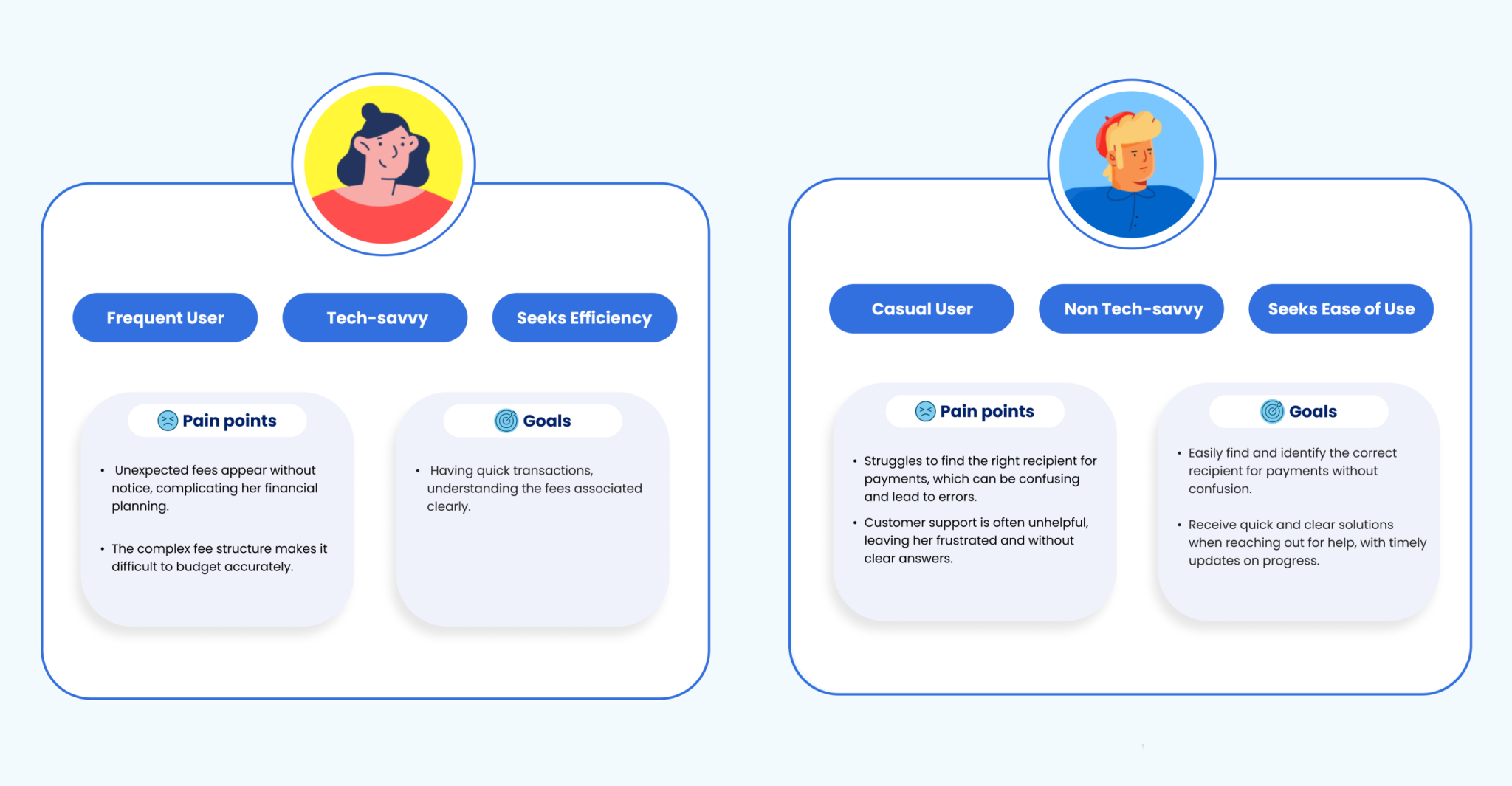

Two very different people face their own challenges and have unique needs. Their priorities reveal where real impact happens and what we should focus on.

Users are already trying to make things work with what’s available but they often feel stuck, frustrated, or let down.

Users just want to know what they’ll pay. No surprises. Hidden fees break trust. Keep it simple, clear, and upfront. It makes all the difference.

When it comes to money, support matters. Users need to feel heard, helped, and confident their concerns are handled with care.

In digital payments, speed and ease aren’t optional. They’re expected. Users want quick, simple transactions they can trust. A smooth experience keeps them coming back.

– Test early with real users to quickly validate ideas, no need for complex prototypes right away. It saves time and sharpens the design.

– Add simple personalization. Let users choose how they view fees or tweak their payment flow. Small touches, big value.